WHAT IS REGULATION 29?

Regulation 29 is the implementation framework for Regulation 28, which introduces unlisted invest-ments as an asset class that institutional investors should consider to enhance returns on their invest-ments and diversify their portfolios. Regulation 28 further strives to reduce the percentage of dual -listed stocks as qualifying domestic assets, reduce the percentage of capital outflow from the country and support the local economy by investing in both viable Greenfield projects and existing business ventures that requires risky capital that existing fi-nancial institutions are not willing to fund due to the high risks associated with those ventures. This will further deepen the financial markets, contribute to skills transfer and employment creation, and allevi-ate some social challenges currently experienced in Namibia.

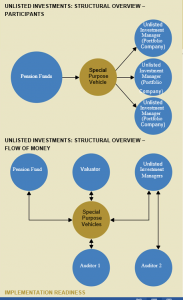

Regulation 29 was therefore introduced to regulate the investment of pension fund assets in unlisted in-vestments. The regulation sets out the requirements pension funds must comply with when they invest in unlisted investments. Regulation 29 stipulates that pension funds must invest in unlisted investments through a Special Purpose Vehicle (SPV), prohibit-ing pension funds from directly investing in unlisted investment managers.

WHY WAS IT INTRODUCED?

The majority of Namibia’s population has not been in a position to fully grasp business opportunities for the past two decades due to past economic setup, and is unlikely to have accumulated significant col-lateral.

In the wake of market developments in the unlisted investment, it has become imperative to design a legislative framework under which such invest-ments can be undertaken.

Through the introduction of Regulation 29, the Gov-ernment would like to achieve the following:

• Increase domestic economic development by utilising contractual savings (pension funds).

• Curb the outflow of capital to enable innovative projects currently struggling to acquire funding.

• Bolster promising investment projects and make domestic savings fruitful for national economic and social developments.

• Provide a framework for the Regulatory Author-ity to regulate these activities.

WHAT REGULATION 29 MEAN FOR

NAMIBIA

Regulation 29 will compel pension funds to invest a minimum of 1.75% of their total assets in local unlisted investments. This is expected to boost eco-nomic growth, diversify the investable universe and deepen capital markets in the country, particularly if some of the unlisted investments made through this regulation eventually list on the stock exchange.

WHICH ENTITIES ARE REQUIRE TO

COMPLY WITH REGULATION 29?

Generally, pension funds and those managing their assets are covered by Regulation 29, i.e.:

• Special Purpose Vehicles (SPV)

• Unlisted Investment Managers (UIM)

UNLISTED INVESTMENTS (UI)

Unlisted investments are investments that take the form of prescribed equity or debt capital in a company incorporated in Namibia and are not listed on any stock exchange, but excluding as-sets such as credit balances, bonds including debentures (issued by government, local au-thorities, regional councils, state-owned enter – prises and corporate).

The requirements for unlisted investments by pension funds are listed as follows:

• All unlisted investments must to be held by SPVs;

• Pension funds are to purchase securities (eq-uity and debentures) issued by SPVs; and

• Prohibit pension funds directly or indirectly

investing in unlisted investment manag-

ers, except when said indirect investment

is through a company listed on a stock ex-change.

SPECIAL PURPOSE VEHICLE (SPV)

A special purpose vehicle is a company or trust organised and operated for the purposes of hold-ing unlisted investments on behalf of investors, and is registered in terms of Regulation 29.

The requirements for special purpose vehicles are listed as follows:

• Requirement for name vetting by Registrar;

• Special purpose vehicle may be a company or a trust;

• Requirement for localisation, documentation, directors or trustees;

• Restrictions on who can be directors or trust-ees of SPVs; and

• Requirement for vetting the investment plan by the Registrar.

Capital Structure of Special Purpose Vehicles:

• If it is a Special Purpose Company (SPC) (Company) – authorised capital forms total “committed capital” if subscribed by inves-tors, drawdown results in paid-up shares in the SPC;

• If it is a Special Purpose Trust (SPT) (Trust) – total subscription interest forms “commit-ted capital” if subscribed by investors, draw-down results in paid-for interests in the SPT;

• If it is an SPC and issues debt, there are two forms of investment:

• Committed (contributed) capital in the form of shares; and

• Holdings of debentures.

The governance of special purpose vehicles

includes:

• Powers, restrictions and duties of SPV, in-cluding the functions and the manner in which such functions will be performed;

• A set financial year;

• Appointment of auditor and valuator; and

• De-registration of SPVs.

UNLISTED INVESTMENT

MANAGERS (UIM)

A special purpose vehicle is a company or trust An unlisted investment manager is any person who is registered in terms of Regulation 29 and engages in the buying, selling or otherwise dealing with unlisted investments on behalf of a special purpose vehicle.

The requirements for unlisted investment man-agers are listed as follows:

• Name reservation and prohibition of unregis-tered managers;

• Requirements for registration, including cap-ital requirements, localisation, directors and principal officer;

• Restriction on directors of UIMs;

• Duties and co-investment requirements;

• Financial year, appointment of auditor and valuator; and

• De-registration of UIMs.

POWERS OF THE REGISTRAR

According to Regulation 29, the Registrar has, in relation to special purpose vehicles and un-listed investment managers, the powers con-ferred upon the Registrar by –

• The Namibian Financial Institutions Supervi-sory Act, 2011 (Act No. 3 of 2001);

• The Inspection of Financial Institutions Act, 1984 (Act No.38 of 1984);

• The Financial Institutions (Investment

Funds) Act, 1984 (Act No. 38 of 1984); and

• Any other financial services law,

– to regulate and supervise special purpose ve-hicles and unlisted investment managers, and any matters incidental thereto.

Further, Regulation 29 states that the Registrar has in relation to a special purpose vehicle, af-ter due notice, the power to remove –

• a)A director or trustee; or

• b)An unlisted investment manager,

– if not in compliance with these regulations or any other applicable law.

IMPLEMENTATION READINESS

With the introduction of Regulation 29, the Authority established a new department that will be responsible for overseeing the unlisted investments and unit trusts schemes. The re-organisation is aimed at creating an effective and efficient manner of exercising supervision over unlisted investment in the interests of investor protection.

CONTACT NAMFISA

The Registrar

NAMFISA

P.O. Box 21250

154 Independence Avenue Sanlam Centre, 1st Floor Windhoek, Namibia

Tel: +264-61-290 5000

Fax: +264 – 61 – 290 5157/8

E-mail address: info@namfisa.com.na Website address: www.namfisa.com.na

For further information or clarification with regards to the above, please do not hesitate to contact Mr. John Naanda or Ms. Valentine Nghipandua at the following, e-mail addresses: jnaanda@namfisa.com.na or vnghipandua@namfisa.com.na